r&d tax credit calculator uk

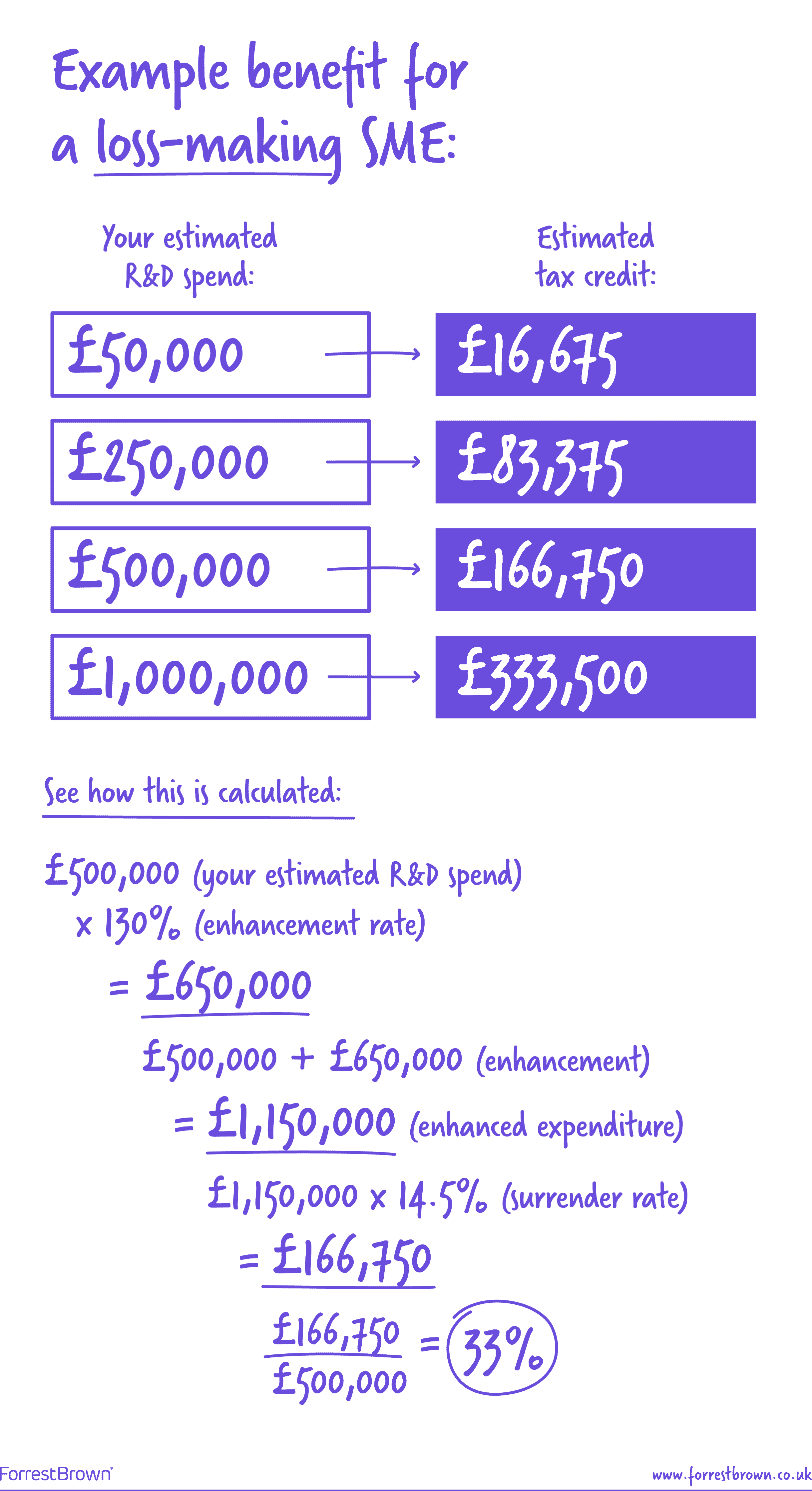

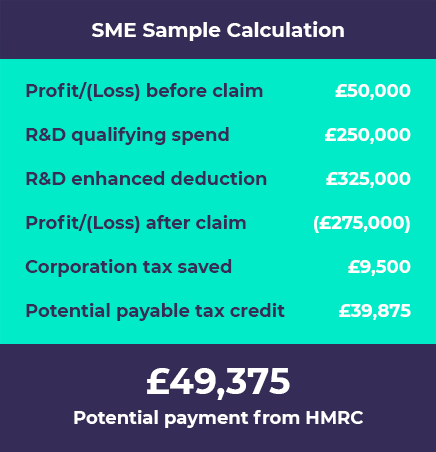

The UK RD tax credit scheme offers UK companies a great opportunity to claim tax relief based on RD costs. Show how this example is calculated.

R D Tax Credit For Financial Services Source Advisors

The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. As a tax credit. Rd report for Based on the information you provided it looks like we could help you claim back up to for.

Im new to Claming. Just follow the simple steps below. RD Tax Credit Calculator.

R. Calculator for RD tax credit Our R and D tax credits calculator RD tax credits. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount.

Check back here soon. The RD Tax Credits scheme is an HMRC incentive designed to inspire innovation and increased spending on RD activities by companies operating in the UK. If the company spent 100000.

Select either an SME or Large. Use our free tool to quickly estimate if youre eligible to claim RD tax relief. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

This can be done for the current financial year and the 2 previous. Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC. Maximise your R.

Roughly how much does your company spend on RD per year. An RDEC tax credit is worth 10 of your qualifying RD expenditure We would be looking at the same peripherals for SMEs and the below points are relevant to an RDEC claim. What is your estimated spend on RD per year.

RD Tax Credits Explained. R D Tax Credit Calculator Our software engineers are busy creating a R D Tax Relief Calculator which will be free to use and does not require any signups. It was increased to.

Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. Tax credits calculator - GOVUK. RD Tax Credits Whether youre new to RD.

RD Tax Calculator Find out how. Across all sectors the average amount reclaimed for our clients is 50000. Our RD tax credit.

How to calculate the RD tax credit using the traditional method. We estimate you could receive up to. 1974100 - 390000 1584100.

The RD Tax Relief for UK small and medium-sized enterprises. Calculate your companys RD tax credit claim.

R D Tax Credit Rates For Sme Scheme Forrestbrown

R D Tax Credits The Essential Guide 2020

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

How To Calculate R D Tax Credits With Examples Kene Partners

Irs Lengthens Transition Period For New R D Tax Credit Reporting Requirements Uhy

Ayming S R D Tax Credit Calculator Ayming Uk

R D Tax Credits Explained What Are They Who Is Eligible

Rdec 7 Steps R D Tax Solutions

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

How To Be Proactive With R D Tax Credits Accountants Guide

Claiming The Texas R D Tax Credit Through The Franchise Tax Credit Specialist R D Tax Advisors

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

R D Tax Credit Claims Could Pay 178k Uk Salaries For A Year Wealth And Finance International

R D Tax Credit Calculator Fi Group Uk

R D Tax Credit Calculator Are You Getting The Full Benefit Of The R D Tax Credit